And now, presenting you the truth behind these two softwares. If you're still deciding which is a better investment then Google no further and scroll down to read my personal reviews after a whole day of initially frustating myself using them, then getting the hang of it and finally deciding which one I liked the best.

No one paid me to write this review, I am just doing this because my husband searched online for countless of personal accounting software, and because I don't want you to do the same and also after reading all the generic reviews online, we decided it's better to judge after we have downloaded the trial versions and it used it ourselves. Being a non-US user, our main criteria were

- multiple currency support, possibly with online currency update

- ease of use

- multi-platform usage, cloud and sync

Let's start alphabetically...

AceMoney

The accounting software comes licensed under mechcad and their website provided plenty of screenshots, which of course the first thing I checked out and immediately liked its GUI. It was simple and appealing. I had worked with Linux platform for 4 years and anything that didn't have too many buttons, options and drop-down meant I can navigate simply with typing words, and one-click editing. Especially when it came to starting off with a negative value balance meant for loan and credit card accounts. Acemoney had all that and more. Among the features they had are:

A function called the "International Setting" so you can change the default American Month-Date-Year (why the Americans go lengths to complicate the most trivial things in life I will never understand) choose a default currency other than USD, set your date separator (date-month date/month date.month) and even choose how you want to see your money, if you have more than 4 figures, that is. If you'd prefer it with a comma, space or whatever (plenty of options there for you to choose from)

And it's so easy to setup an account. They have 5 options to creating an account:

- bank accounts

- cash accounts

- loan accounts

- investment accounts

- credit accounts

I used the cash, loan and credit accounts so far because that's all that I have. Once my condominium mortgage has been paid up the loan account will move to investment account and rental I get from there will be my investment.

The husband and my bank accounts

The feature that I really liked is the negative value for credit and loan accounts. Because I keyed in the amount manually and if it's credit all I have to do is add a negative in front of the amount and it goes straight into the credit field of the account and on your main page you can view your credit, debit and outstanding balances side by side and the grand total is shown at the bottom of the page

The other thing I find totally unnecessary and I wished accounting software will stop doing is providing hundreds of pre-loaded payee fields. Why not just let the user create their own payee names? It's just time wasting to scroll down hundreds of options just to find one that suits. An average user is going to scroll up and down at least 2 times to find the most appropriate payee name for a payment. It's just time wasting, if you're the person who likes pre-loaded payee then you will find that the payees here are alphabetically organised side by side with a sub-category so its very easy (depends on how you view this function) if you have a lot of bills (car payments and maintenance, magazines and newspaper subscriptions, cable tv subscriptions, etc)

Payees list. If you don't like what you see and if it's too confusing for you to take it all in then create something simpler like what I did (screenshot below)

I did use one of the pre-loaded functions tho, for my monthly rental payment (screenshot below)

The one thing I really liked about this software is the scheduling tool. If you have an outstanding instructions with your bank to auto deduct/auto-debit your loans or car payments then this is a good way to keep track of your money flow.

Calendar-view scheduling tool

And this is how you setup auto-payment/auto-debit/outstanding instructions. Here I used the money from my Savings Account to pay for the bank loan I had taken from the same bank (it doesn't matter if your bank is different, the software doesn't link with banks out of US and Canada so it's manually choosing the bank from the list you created earlier--Cash Account to Loan Account)

Because I linked the payment from my Savings to my Loan payment accounts, and set it up in the calendar to auto-pay on the 2nd of every month I get two months advanced payment notice. In the screenshot above, you can see that they have calculated my loan payment & balance for February as well

Ok, now the drawbacks of this software

- no Andriod app compatibility, but they're working on it (except for Windows Mobile, who the fuck uses Windows Mobile)

- no cloud/online storage compatibility (but they're working on it)

- no sync available with other machine, you have to buy separate license for each computer

- you have to manually update the currency daily/weekly. Bad if you're staying in an unstable currency of a country (Zimbabwe and such)

BankTree

BankTree, like its British developers comes on a saucer with teatitude. Literally. It took me longer to find my way around the software, and at the end of the day I ended up asking myself this-that's it?

BankTree is suitable for non-US, non-USD currency user I will give you that, they have a familiar Outlook layout, with a two-panel transaction and reminder/schedule field and all your accounts are listed on your left.

The software has a bug, if you choose the first option (cash account) to creating an account, from the scroll down options to setting up your account you can't change the account to Investment account. You will have to delete the account and recreate it with an Investment account option

I know some users are worried about their account safety, and for that reason I discourage you to key in your actual bank account number into any 3rd party accounting software (Acemoney, Banktree, Quicken, Mint, etc) but if you did and you want to protect your account from being deleted then you can always password protect it

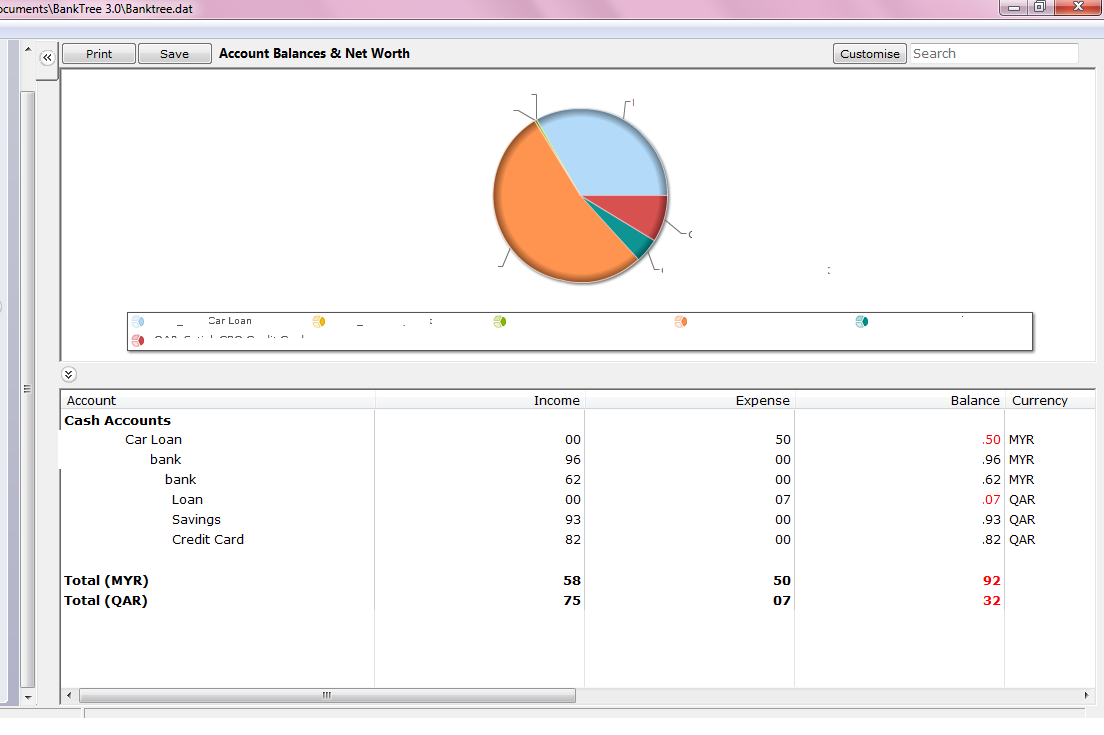

I had a very time balancing my Savings and Loans account, because they were linked to each other. My Savings account paid for my Loans account. The embedded calculator doesn't allow me to input a negative value, so I had to manually change it in the Paid column. Which Paid column? I played around with the Paid In, Paid Out and Category column until I figured in order to get a negative value for a loan amount, I have to key in the amount in the Paid Out column which in turn will appear in red and in negative value under the Balance column (see screenshot below) The double sided arrow meant money taken from a "QAR" account to pay for the Loan. Before I forget let me tell you about the one good feature of this software that I really liked. Since I have accounts in two different currencies, at the end of the accounts, I have two account totals, one for each currency. This is really good if you want separate balances to show up in your monthly report.

And just like the previous software, this one also had too many pre-loaded categories to choose from, but I managed to find one that suited me (this example shows a rental payment)

I could not find the pretty month scheduling I was expecting from BankTree other than the default one provided under each account. Nor was I able to change the default view to monthly or weekly view.

I will give BankTree credit for being able to pull up pretty reports. They have plenty of options to choose from, just look under the Cash/Investment Accounts for the Reports pull down button and you will find yourself surrounded by an array of choices of reports that you'd like to pull up. I tried two and I liked the way the pie and graph chart showed my expenses report. You can see where the bulk of my money is going to, how much I have left in my Savings, Mortgages, Loans, etc

Comparisons of both software

Ease of use, navigation, help menu

AceMoney hands down,the software comes with an offline help support. BankTree has an online help support, no offline help pages attached with the software

Monthly Reports

BankTree has more options to view the reports, ranging from monthly budget to spending by payee. AceMoney has a decent report option, it shows in bank-statement-like numerical format and has two other default charts as well but a quick look at the help page tells me that I can customize my report (done manually of course with the filtering options available) And of course both software are compatible with Excel sheets

Currency Converter and Multi Currency Accounts

If you have accounts in multiple currencies and want to keep track of them in a single currency then AceMoney is your dough. You will have to regularly click on the currency exchange button on the software to keep your accounts updated. All your accounts will be balanced in a single currency

If you have accounts in multiple currencies and want to keep track of them in their original currency then BankTree is the right software for you. All your accounts will be balanced according to the currency they're setup with

Cloud Support

Acemoney states that they're working on it. I didn't see anything on BankTree. Like I've said before this is a very Britishy software and majority of their clients are based in UK (just look at their payee list) so unless the demand there rises for the need of it, then you will get cloud storage.

Price

BankTree is suitable for non-US, non-USD currency user I will give you that, they have a familiar Outlook layout, with a two-panel transaction and reminder/schedule field and all your accounts are listed on your left.

The two options you have to creating your account

The software has a bug, if you choose the first option (cash account) to creating an account, from the scroll down options to setting up your account you can't change the account to Investment account. You will have to delete the account and recreate it with an Investment account option

I know some users are worried about their account safety, and for that reason I discourage you to key in your actual bank account number into any 3rd party accounting software (Acemoney, Banktree, Quicken, Mint, etc) but if you did and you want to protect your account from being deleted then you can always password protect it

I had a very time balancing my Savings and Loans account, because they were linked to each other. My Savings account paid for my Loans account. The embedded calculator doesn't allow me to input a negative value, so I had to manually change it in the Paid column. Which Paid column? I played around with the Paid In, Paid Out and Category column until I figured in order to get a negative value for a loan amount, I have to key in the amount in the Paid Out column which in turn will appear in red and in negative value under the Balance column (see screenshot below) The double sided arrow meant money taken from a "QAR" account to pay for the Loan. Before I forget let me tell you about the one good feature of this software that I really liked. Since I have accounts in two different currencies, at the end of the accounts, I have two account totals, one for each currency. This is really good if you want separate balances to show up in your monthly report.

And just like the previous software, this one also had too many pre-loaded categories to choose from, but I managed to find one that suited me (this example shows a rental payment)

I could not find the pretty month scheduling I was expecting from BankTree other than the default one provided under each account. Nor was I able to change the default view to monthly or weekly view.

I will give BankTree credit for being able to pull up pretty reports. They have plenty of options to choose from, just look under the Cash/Investment Accounts for the Reports pull down button and you will find yourself surrounded by an array of choices of reports that you'd like to pull up. I tried two and I liked the way the pie and graph chart showed my expenses report. You can see where the bulk of my money is going to, how much I have left in my Savings, Mortgages, Loans, etc

Comparisons of both software

Ease of use, navigation, help menu

AceMoney hands down,the software comes with an offline help support. BankTree has an online help support, no offline help pages attached with the software

Monthly Reports

BankTree has more options to view the reports, ranging from monthly budget to spending by payee. AceMoney has a decent report option, it shows in bank-statement-like numerical format and has two other default charts as well but a quick look at the help page tells me that I can customize my report (done manually of course with the filtering options available) And of course both software are compatible with Excel sheets

Currency Converter and Multi Currency Accounts

If you have accounts in multiple currencies and want to keep track of them in a single currency then AceMoney is your dough. You will have to regularly click on the currency exchange button on the software to keep your accounts updated. All your accounts will be balanced in a single currency

If you have accounts in multiple currencies and want to keep track of them in their original currency then BankTree is the right software for you. All your accounts will be balanced according to the currency they're setup with

Cloud Support

Acemoney states that they're working on it. I didn't see anything on BankTree. Like I've said before this is a very Britishy software and majority of their clients are based in UK (just look at their payee list) so unless the demand there rises for the need of it, then you will get cloud storage.

Price

- AceMoney USD 34.99

- BankTree USD 39.99

The price difference margin is really small, so it's up to you to decide which one you liked better

I've used Banktree version 2 for several years, and only last month upgraded to version 3. This weekend however I've installed Acemoney, and find it much easier, far less buggy, better designed. Why have I ditched Banktree so soon following 2 years' use and an upgrade 4 weeks ago? See below for their response to my recent support request:-

ReplyDeleteMy request is about: BankTree Personal Finance version 3.0

Message:

Hi.

Each time I import transactions from any of my financial institutions the account balances in Banktree do not change, nor are the transactions visible.

I recall this occurring in the previous version if the relevant institution's account was open in Banktree at the time of import, but refreshing was simply a matter of moving to another account and back again. In version 3 following an import, I can only make the imported transactions visible by exiting and restating the software. (The F5 key 'refresh' option under the Edit menu redraws the screen, but still fails to display the newly-imported transactions; only a quit and restart seems to achieve this.)

Can you advise please? Regards,

Steve

Date: 2014-03-14 00:41:40

Name: BankTree Support

Make sure you are running the latest update.

Best regards,

BankTree Support

Web: http://www.banktree.co.uk

Facebook: http://www.facebook.com/banktree

Date: 2014-03-14 08:22:42

Message:

I am running the latest update

Date: 2014-03-14 14:51:53

Name: BankTree Support

Which is ?

Best regards,

BankTree Support

Web: http://www.banktree.co.uk

Facebook: http://www.facebook.com/banktree

I mean, could you BE any ruder?

That's why they're made in England. Pompous tea drinkers!

DeleteSTEVE CONWAY from Cheshire, United Kingdom, ENGLAND! Why didn't you post our full response which we made BEFORE you posted this post.

DeleteDate: 2014-03-15 12:04:09

Name: Stephen Conway

Message:

3.14.5

Date: 2014-03-15 14:38:39

Name: BankTree Support

Message:

If the import is done via File > Import then it refreshes ok. If it is done by opening the QIF/OFX which launches a 2nd version of the BankTree application for the import it doesn't refresh. We will look into this to see if it is fixable or not. The 2nd import application is running as windows system account and it seems to cache the data file.

Best regards,

BankTree Support

Web: http://www.banktree.co.uk

Facebook: http://www.facebook.com/banktree

Maybe . . .

ReplyDeletehttp://www.companiesintheuk.co.uk/directors/banktree-software

Better link for background info on Banktree. Looks a small operation. (Tip - disable JavaScript to avoid the popup)

ReplyDeletehttps://www.duedil.com/company/07276577/banktree-software-limited

BROCADE BLUE thanks for the review of our software. Your review was within 1 week after release, of our software which was a complete re-write of our previous version so some hang ups were expected. Version 3.0 has now been out for a few months and is a lot more stable, and well supported with online tutorials in a nice 'British Accent' :)

ReplyDeleteGood to hear that...I have been using Acemoney for over a year now and its worked fine with me. Of course being the un-ethical user that I am, I am using a cracked.

DeleteI'd like to add one more security feature I found on Ace Money and it is just so intriguing I will share it here with all users. I installed AM on my Dell and after the motherboard fried, I salvaged data from the HDD and the .amj file wouldn't open on my brand new Acer laptop unless I input my Dell computer name!

Then my Acer's keyboard went kaput and I had to reinstall the OS. After installing the cracked version of AM, again the .amj file wouldn't open so I had to use the Acer's computer name before I had reformatted it to view the file

So happened here was after the original .amj file was moved from one PC to another PC it remembered the last PC name and there is no fucking way you can open the .amj file unless you remembered your old PC name where you LAST saved the file!

So I did the next best thing-I saved it on an USB HD

I was about to get Banktree but that email exchange has put me right off, I shall play with AceMoney. Thanks for the review.

ReplyDelete